ESG Investor Relations

Integrate ESG Into Your Business Model And Meet Investors’ Expectations

Can Your Organization Attract Investors By Being More Sustainable?

A sustainable business is an enterprise that has a minimal negative impact on the global and local environment, community, society, and economy.

A Sustainable Business:

- Understands the climate-related risks and financial impact

- Prepares for upcoming environmental regulations

- Conducts business as if people and place matter

- Implements environmental programming to reduce energy, water, and waste

- Strives to be a leader in climate action and provides education to their employees and other stakeholders on how to become better stewards of the environment

- Tracks carbon footprint data and provides transparent reporting to stakeholders

- Designs and creates products or services that aspire to do no harm and benefit all

- Develops Supply Chain Standards

- Develops effective sustainability communications strategies for both internal and external stakeholders

Most businesses want to make a difference and are doing a variety of sustainable initiatives but are not using Environmental, Social, and Governance (ESG) principles to evaluate, report, and communicate to investors how far advanced they are with sustainability.

Why ESG?

Investors and other stakeholders want greater transparency on how organizations are managing their ESG risks and opportunities and integrating them into their business strategy.

With growing concern about the ethical status of organizations of all sizes, these standards are the central factors that measure the ethical impact and sustainability of investment in a company.

What Is ESG?

All businesses, regardless of size, can integrate Environmental, Social, and Governance (ESG) principles into their business strategies.

What Investors Look For In Corporate ESG

ESG Components Help Investors Manage Risk And Generate Sustainable, Long-Term Returns

Value Creation

Risk Reduction

Efficient Operations

Employee commitment

Higher Productivity

Ethical Supply Chains

ESG Is A Growing Focus For Investors

Investors now clearly recognize there is a link between how companies navigate environmental, social and governance (ESG) performance and the financial performance of the companies they invest in.

Issues like climate change, carbon emissions, diversity, equity and inclusion, and executive pay are top priorities for investors.

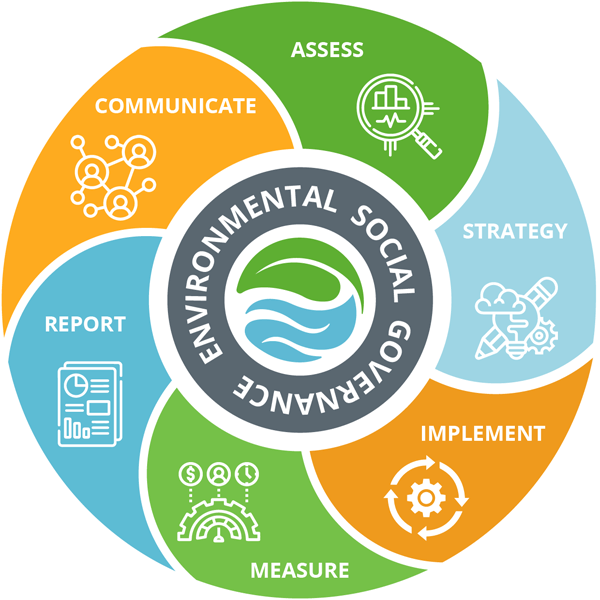

Here Are The 8 Steps We Take Within Our Scaleup Process For Accelerating Your ESG And Investor Relations

Step #1 Climate Risk Analysis

Climate risk assessments identify the likelihood of future climate hazards and their potential impacts on your business. This is fundamental for informing the prioritization of climate action and investment in adaptation.

- Quantify Your Baseline Carbon Footprint

- Apply Scenario Analysis

- Identify Opportunities

- Set Targets

- Create A Report To Share With Your Stakeholders

Step #2 Analyze The ESG Expectations Of Your Investors

Different investors can have very different strategies and policies for ESG. The first critical step to improving your ESG investor relations is understanding how your key investors approach ESG – be they institutional investors, asset managers or funds.

We can help you understand your investors better by performing a wide-ranging ESG analysis of your current and desired investor base.

Step #3 Understand How Your Investors Perceive Your ESG Performance And Strategy

Understanding the views of your investors is a critical step toward designing a more effective ESG investor relations strategy. We conduct investor engagement programs to determine what investors think about your ESG performance and strategy. The engagement process will also reveal how the investor’s approaches to ESG are developing and the implications for your organization and sector.

Step #4 Evaluate Your Organization Against Your Competitors

Peer benchmarking analysis can show how your company’s ESG strategy and investor communications activity measure up against others in your sector. These analyses no longer focus primarily on environmental issues but take a broad ESG view and emphasize diversity, equity, inclusion, social impact, and value creation for society.

Step #5 Embed ESG Strategies Into Your Operating Model And Structure

Many organizations will need to change their operating model and structure to deliver on their ESG and sustainability goals. Backed by our ScaleUP process and AI-driven technology, we’ll help you determine your budget and develop strategies to integrate into your operating model and systems.

Step #6 Implement and Measure ESG Goals

We will identify the internal roles to support your ESG implementation and partner with you to seamlessly implement your short- and long-term executive goals. Then we will put the appropriate measurement mechanisms in place to achieve your ESG goals. This includes recommendations on the restructuring or rebalancing of your executive annual and long-term incentives to include ESG objectives.

Step #7 Report

ESG from an investor’s perspectiveis about complete ESG financial materiality data tracking and sharing it with your stakeholders in a transparent manner. We use the TCFD reporting structure that gives transparency and credibility to your environmental efforts and is guided by SASB and UN Sustainable Development Goals.

Step #8 Improve The Quality Of Your ESG Investor Communications

ESG Reporting Attracts New Investors and Other Stakeholders By Bringing Credibility To Your Sustainably Efforts

We use the world’s most widely used sustainability reporting standards that enable comprehensive, credible, and effective reporting and communications.

UN Sustainable Development Goals

ScaleUP integrates the UN Sustainable Development Goals (SDGs)

United Nations Global Compact

ScaleUP promotes the Ten Principles of the United Nations Global Compact (UNGC)

Science Based Targets Initiative

We align emissions reductions targets with the latest climate science

Sustainability Accounting Standards Board

ScaleUP follows SASB Standards reporting on the financial impacts of sustainability

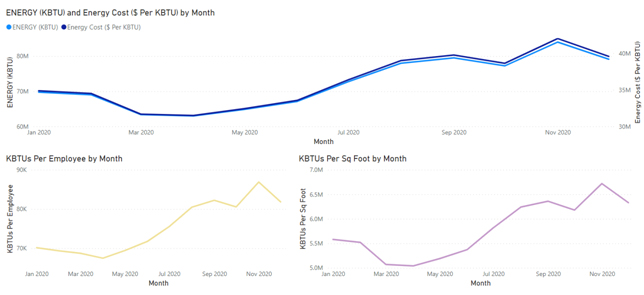

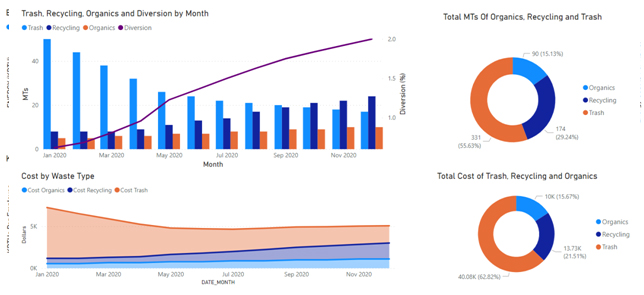

We Use Leading Technology

Our ESG platform follows the UN Sustainable Development Goals, is ISO Certified, an official partner of GRI, SASB, World Economic Forum, and a signatory of PRI.

Our Technology Supports Companies Regardless Of Their Size, Industry, Or Sustainability Experience

Your Investor Relations Team Is With You Every Step Of The Way

The mission of your ECOCAUSE Investor Relations team is to help you understand climate-related risks and create a resilient business that delivers value for people and the planet.

It’s Time To Do Things Differently

The world has changed. People want to be part of something worthwhile and get behind something they believe in.

It’s Not Enough To Turn A Profit. You Must Make A Difference.

CONTACT US NOW TO TAKE SIMPLE, COST-EFFECTIVE STEPS TOWARD BEING MORE SUSTAINABLE TODAY!